The Value Of A Tulsa Bankruptcy Lawyer In Achieving A Fresh Start

Table of ContentsTulsa Bankruptcy Lawyer: The Most Common Types Of CasesTulsa Bankruptcy Lawyer: Tips For Recovering From Personal BankruptcyBankruptcy Attorney Tulsa: How To Keep Your Home During BankruptcyBankruptcy Attorney Tulsa: A Guide To Chapter 7 And Chapter 13

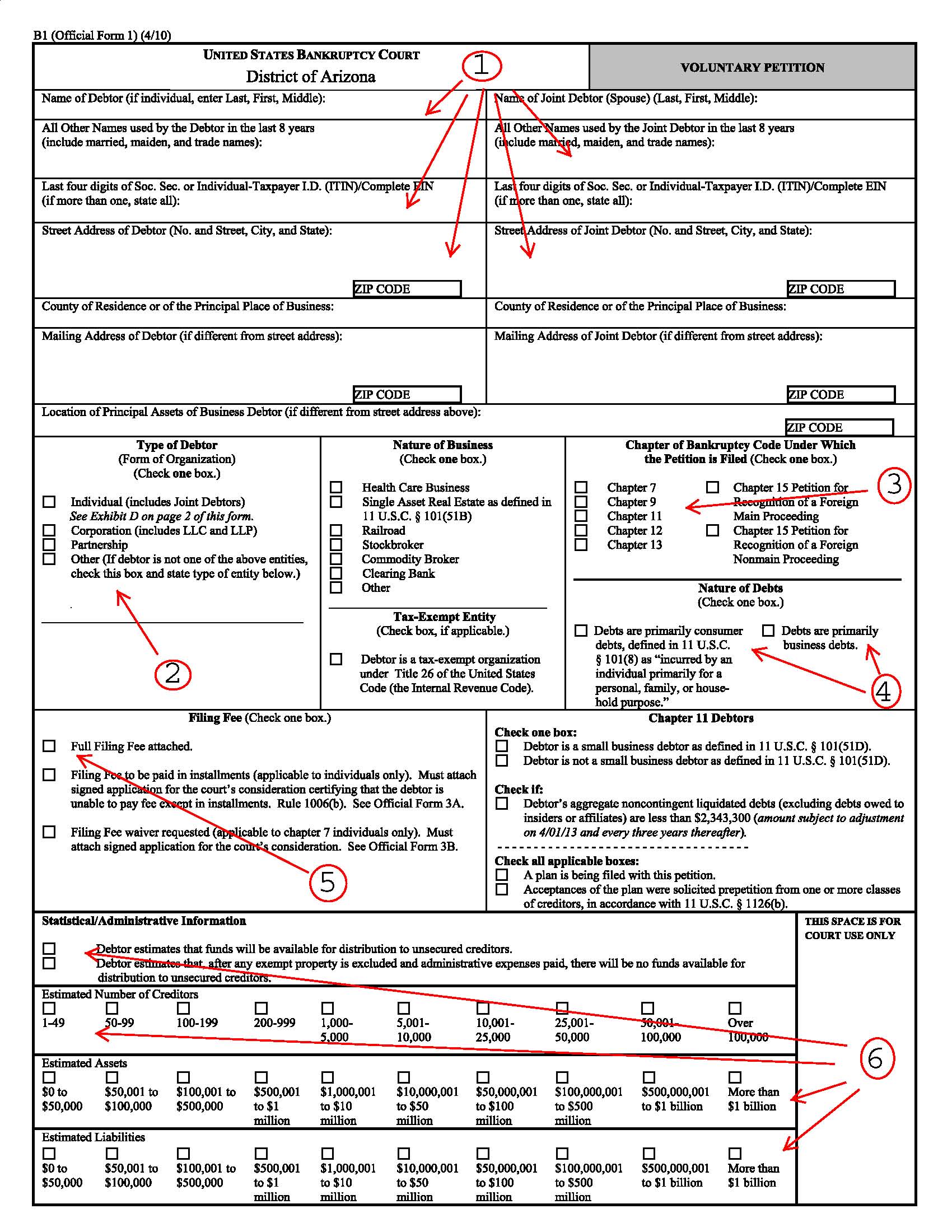

It can damage your credit report for anywhere from 7-10 years and also be a barrier toward getting safety and security clearances. Nevertheless, if you can not solve your problems in less than 5 years, insolvency is a practical choice. Legal representative costs for personal bankruptcy vary depending upon which develop you select, how intricate your instance is and also where you are geographically. bankruptcy lawyer Tulsa.Other personal bankruptcy expenses include a declaring charge ($338 for Chapter 7; $313 for Phase 13); and costs for credit history counseling as well as monetary administration courses, which both cost from $10 to $100.

You do not constantly require a lawyer when filing specific insolvency on your own or "pro se," the term for representing yourself. If the situation is basic sufficient, you can apply for bankruptcy without assistance. But a lot of individuals benefit from depiction. This post describes: when Phase 7 is also made complex to handle yourself why working with a Phase 13 attorney is always important, and also if you represent on your own, exactly how a personal bankruptcy petition preparer can aid.

The general rule is the simpler your personal bankruptcy, the far better your chances are of finishing it on your very own and also receiving an insolvency discharge, the order removing financial obligation. Your case is likely easy adequate to handle without an attorney if: However, even simple Phase 7 situations require job. Intend on filling up out extensive paperwork, collecting monetary documentation, researching personal bankruptcy and also exemption legislations, and also following regional policies and also procedures.

Overcoming Debt: How A Tulsa, Ok Bankruptcy Attorney Can Help

Below are two scenarios that always call for representation. If you possess a local business or have income above the typical level of your state, a considerable quantity of properties, concern debts, nondischargeable debts, or financial institutions who can make insurance claims against you based on scams, you'll likely want a lawyer.

Filers do not have an automatic right to dismiss a Phase 7 case. If you make an error, the personal bankruptcy court can toss out your situation or market assets you assumed you could maintain. You can likewise deal with a personal bankruptcy claim to determine whether a debt shouldn't be discharged. If you shed, you'll be stuck paying the debt after bankruptcy.

Filers do not have an automatic right to dismiss a Phase 7 case. If you make an error, the personal bankruptcy court can toss out your situation or market assets you assumed you could maintain. You can likewise deal with a personal bankruptcy claim to determine whether a debt shouldn't be discharged. If you shed, you'll be stuck paying the debt after bankruptcy. You could want to submit Phase 13 to capture up on home mortgage defaults so you can keep your home. Or you could want to eliminate your bank loan, "pack down" or reduce a vehicle loan, or pay back a financial obligation that will not vanish in personal bankruptcy over time, such as back tax obligations or support defaults.

You could want to submit Phase 13 to capture up on home mortgage defaults so you can keep your home. Or you could want to eliminate your bank loan, "pack down" or reduce a vehicle loan, or pay back a financial obligation that will not vanish in personal bankruptcy over time, such as back tax obligations or support defaults.In several situations, a personal bankruptcy lawyer can swiftly determine problems you might not find. Some people documents for bankruptcy because they do not comprehend their alternatives.

Top 5 Qualities To Look For In A Bankruptcy Lawyer Tulsa

For a lot of customers, the rational choices are Chapter 7 and also Phase 13 personal bankruptcy. Each kind has certain benefits that resolve certain issues. If you desire to save your residence from foreclosure, Chapter 13 may be your best wager. Chapter 7 could be the way to go if you have low earnings as well as no possessions.

Avoiding paperwork risks can be troublesome also if you select the correct phase. Below are typical issues bankruptcy attorneys can stop. Insolvency is form-driven. You'll have to complete a prolonged government packet, as well as, in some situations, your court will also have regional forms. Many self-represented bankruptcy borrowers do not file all of the called for bankruptcy papers, and also their instance gets rejected.

You don't shed whatever in insolvency, however maintaining residential or commercial property depends on comprehending exactly how home exceptions job. If you stand to lose useful property like your home, cars and truck, or other building you appreciate, a lawyer could be well worth the money. In Chapters Tulsa bankruptcy attorney 7 and also 13, personal bankruptcy filers have to obtain credit history counseling from an authorized service provider prior to filing for personal bankruptcy and also complete a financial management program on trial releases a discharge.

Most Phase 7 situations move along predictably. You apply for personal bankruptcy, go to the 341 conference of financial institutions, as well as get your discharge. Not all personal bankruptcy situations continue efficiently, and other, extra difficult issues can emerge. For example, many self-represented filers: don't comprehend the relevance of motions and adversary activities can not visit the website effectively resist an activity looking for to refute discharge, and have a tough time abiding by complex bankruptcy procedures.

The Importance Of Hiring A Specialized Bankruptcy Lawyer In Tulsa

Or another thing could appear. The bottom line is that a lawyer is important when you discover yourself on the receiving end of a movement or legal action. If you decide to declare insolvency by yourself, learn what solutions are offered in your area for pro se filers.

, from brochures describing affordable or cost-free solutions to in-depth details concerning insolvency. Look for a personal bankruptcy book that highlights scenarios needing an attorney.

You have to properly load out several forms, study the law, and also go to hearings. If you understand insolvency law but would certainly such as help finishing the kinds (the standard bankruptcy request is about 50 web pages long), you may think about working with an insolvency application preparer. A bankruptcy request preparer is any kind of individual or service, other than a lawyer or somebody that works for a lawyer, that charges a cost to prepare personal bankruptcy records.

Since personal bankruptcy application preparers are not lawyers, they can not provide lawful suggestions or represent you in bankruptcy court. Particularly, they can't: tell you which type of insolvency to file tell you not to list certain debts inform you not to provide particular properties, or tell you what residential property to excluded.

Since personal bankruptcy application preparers are not lawyers, they can not provide lawful suggestions or represent you in bankruptcy court. Particularly, they can't: tell you which type of insolvency to file tell you not to list certain debts inform you not to provide particular properties, or tell you what residential property to excluded.